refund for unemployment taxes 2020

I foolishly filed my tax return on the day they passed the legislation that excluded the first 10200 of unemployment income from federal taxes. You are eligible for a property tax deduction or a property tax credit only if.

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

During a normal year unemployment benefits are taxed as regular income which means youll need to pay income.

. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally. We will begin paying ANCHOR. The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your.

Tax refunds on unemployment benefits to start in May. Did not claim CalEITC. For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of.

The American Rescue Plan ARP signed by President Joe Biden in March excluded up to 10200 in 2020. Here is more information about unemployment tax. Email Tax Supportemail protected 2020 State Tax Filing Deadline.

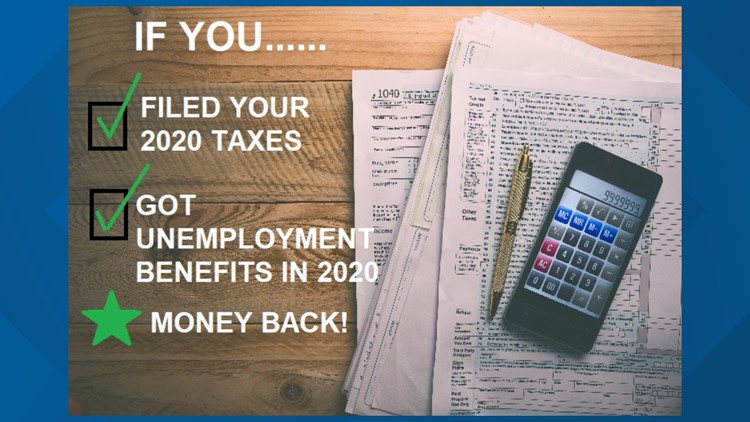

What is status of my 2020 taxes refund for unemployment. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in.

We will mail checks to qualified applicants as. The deadline for filing your ANCHOR benefit application is December 30 2022. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

The IRS has sent 87 million unemployment compensation refunds so far. Taxpayers can expect to receive a refund of 1265 on average. However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Visit Wait times to review normal refund and return processing timeframes. Property Tax Relief Programs.

Refund Status Phone Support1-800-382-9463 1-860-297-5962 Hours. Recalculated taxes on 2020 unemployment benefits. Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits.

They say dont file an amended return. The refunds will happen in two waves. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during.

The tax rate for a start-up entrepreneur is 10 for the first year of liability 11 for the second year of liability and 12. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to. You would be refunded the income taxes you paid on 10200.

New income calculation and unemployment.

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

When Can You File Taxes Where Is My Tax Refund Check Money

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment Tax Refund 169 Million Dollars Sent This Week

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com

Dor Unemployment Compensation State Taxes

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Tax Refund Delay What To Do And Who To Contact Smartasset

Interesting Update On The Unemployment Refund R Irs

When Will Irs Send Unemployment Tax Refunds 11alive Com

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

If You Received Unemployment Benefits In 2020 A Tax Refund May Be On Its Way To You Youtube

Confused About Unemployment Tax Refund Question In Comments R Irs